Prime Minister

Narendra Modi has announced a new digital payments app called BHIM based on the Unified Payments Interface (UPI). The app is currently available only on

Android; so

iOS,

Windows mobile users etc are left out. BHIM is also supposed to support Aadhaar-based payments, where transactions will be possible just with a fingerprint impression, but that facility is yet to roll out.

So what can BHIM app do?

BHIM is a digital payments solution app based on Unified Payments Interface (UPI) from the National Payments Corporation of India (NPCI). If you have signed up for UPI based payments on your respective bank account, which is also linked to your mobile number, then you’ll be able to use the BHIM app to conduct digital transactions.

BHIM app will let you send and receive money to other non-UPI accounts or addresses. You can also send money via IFSC and MMID code to users, who don’t have a UPI-based bank account. Additionally, there’s the option of scanning a QR code and making a direct payment. Users can create their own QR code for a certain fixed amount of money, and then the merchant can scan it and the deduction will be made.

So BHIM app is like another mobile wallet?

No, BHIM app is not a mobile wallet. In case of mobile wallets like

Paytm or MobiKwik you store a limited amount of money on the app, that can only be sent to someone who is using the same wallet. So if I have a Paytm account it won’t be possible for me to send money to someone on MobiKwik.

But BHIM is based on UPI, which is the Universal Payments Interface and thus linked directly to a bank account. Your friend, relative or even a merchant who you’re trying to pay doesn’t necessarily need to be on the BHIM app. All they need is a bank account to receive the payment.

If they have UPI activated, you can just ask for their VPA or virtual payment address, and just make a payment to that account. So for instance, if I have a VPA at SBI which could be called shrutid@SBI, then I can just send my friend that bit of information and he/she can transfer it straight from BHIM. Otherwise there’s the option of IFSC code or MMID for sending/ receiving money.

The advantage is I don’t need to remember my account number or share that with everyone. This VPA is all that is needed to transfer funds.

Which banks are supported by BHIM app?

There’s a pretty comprehensive list of banks that are supporting BHIM app for UPI-based payments. The list includes Allahabad Bank, Andhra Bank, Axis Bank, Bank of Baroda, Bank of Maharashtra, Canara Bank, Catholic Syrian Bank, Central Bank of India, DCB Bank, Dena Bank, Federal Bank, HDFC Bank, ICICI Bank, IDBI Bank, IDFC Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Oriental Bank of Commerce, Punjab National Bank, RBL Bank, South Indian Bank, Standard Chartered Bank, State Bank of India, Syndicate Bank, Union Bank of India, United Bank of India, and Vijaya Bank.

So exactly does BHIM work? How many accounts can I link to the BHIM app to make payments?

BHIM lets you choose your preferred bank after it has verified your mobile number. The app sends an SMS via the SIM in your phone. So it is best if your phone has the same mobile number as the one that is linked to a bank account.

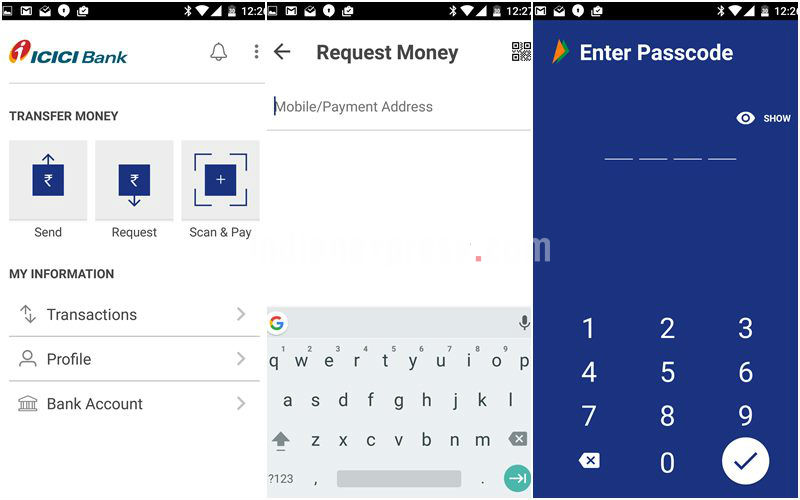

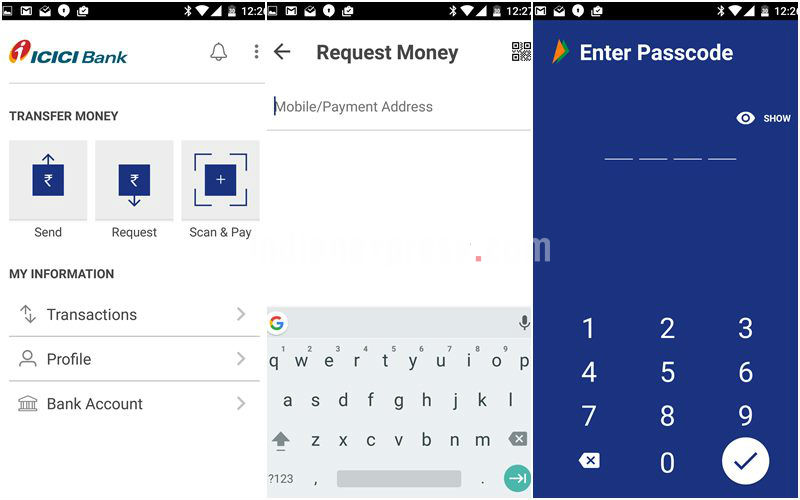

Make sure there is enough balance for BHIM to send out an SMS. In our case, we’ve gotten some cases of device binding failure, but after a couple of tries the app got synced in one of phones. The app will then ask you to set a passcode (4 digit), which you can choose. Keep something you don’t forget easily because you will need the code every time you open the app.

Your friend, relative or even a merchant who you’re trying to pay doesn’t necessarily need to be on the BHIM app.

Your friend, relative or even a merchant who you’re trying to pay doesn’t necessarily need to be on the BHIM app.

Once that is done, the app will ask you to select from the relevant bank. Choose your bank, if UPI is activated it will reflect the relevant account number, and you’ll be able to see an option to send money, receive money, share via IFSC code.

If UPI is not activated, you can just put in six digits of your debit card and the expiry date. You then create a UPI pin. Once done, the app will let you perform the needed functions.

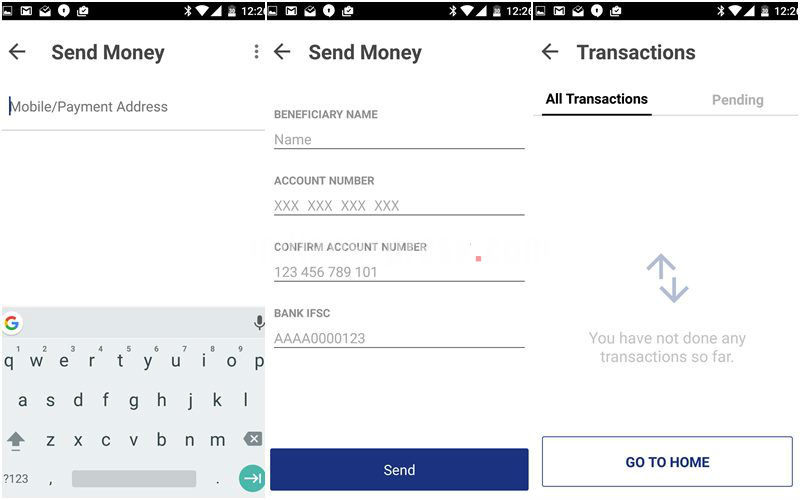

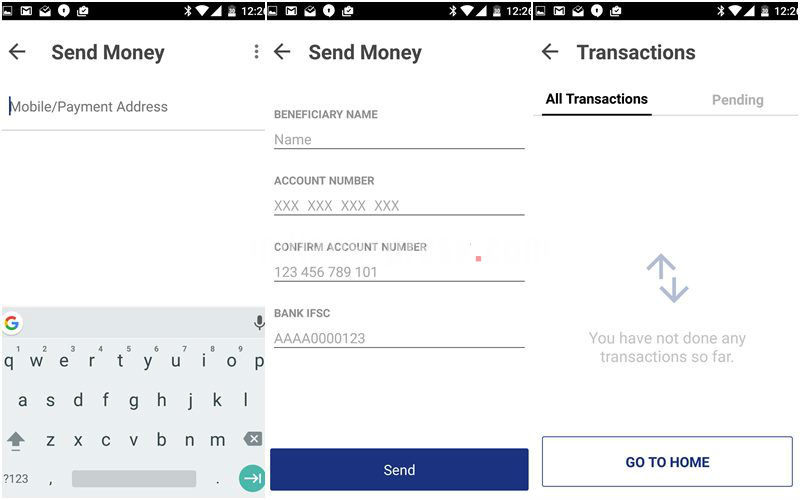

Then just click on send money. Type in the mobile number or bank VPA address. It will also verify the user to whom you are sending the money. Type in the amount, and hit pay.

BHIM also has options to transfer via IFSC, MMID as well for non-UPI banks.

BHIM also has options to transfer via IFSC, MMID as well for non-UPI banks.

If your friend doesn’t have UPI, on top of the send money option, you will see three dots. Tap on that and the ACCOUNT+IFSC option will open up. Put in the details there, and you’ll be able to transfer money.

The problem is that if your mobile number is linked to two accounts, you can only access one for now. If you want to switch, you have to disable the selected one and go back to the bank selection option again. To transfer money you just need your friend or even merchant’s mobile number or VPA which they should be able to give if they have a UPI account..

Ok so what is this UPI and how do I check if my bank supports it?

According to NPCI’s own website, when UPI went live in August 2016, the list of banks with supporting apps on

Google Play Store Store looked like this: Andhra Bank, Axis Bank, Bank of Maharashtra, Bhartiya Mahila Bank, Canara Bank, Catholic Syrian Bank, DCB Bank, Federal Bank, ICICI Bank, TJSB Sahakari Bank, Oriental Bank of Commerce, Karnataka Bank, UCO Bank, Union Bank of India, United Bank of India, Punjab National Bank, South Indian Bank, Vijaya Bank and YES Bank.

HDFC bank’s Android app also started supporting UPI. Then in November, SBI’s own UPI-support app called SBI Pay went live. So far thirty apps have signed up for UPI. Also as Indian Express had noted in a report, “five other public sector banks are yet to join the UPI interface.” This is an issue because many people in India still have bank accounts in a PSU.

The other problem is that UPI based payments only work on Android phones, which means iOS users can forget about conducting these sort of transactions.

So how do I go about creating a VPA for UPI on bank account?

First up you need to support app-based mobile banking. Make sure you mobile number is linked to your bank account, and then go on to install your bank’s official app from the Google Play Store. Do check the developer, etc before installing because you need to make sure you are not downloading a malicious or fake app masquerading as one from your bank. If unsure which is the right app, check with the bank about the same.

Once you have the app from a bank that supports UPI-based payments on Android, you’ll be able to locate a tab regarding UPI payments. In this you can go and create a VPA, which is what will be used to conduct all UPI-based transactions. Keep VPA simple so that you don’t forget it in the future; as we explained VPA will look something like this shruti@icici or shruti@sbi, etc depending on bank. Then create a UPI pin as well for conducting future transactions.

After your VPA is created, you’ll see options to send, receive money or pay via scanning QR code. If you have more than one bank account with the same bank, you can also choose which one will be the default account for transactions via UPI.

Essentially this VPA is all you need to conduct a transaction, no need to put in a debit card when making payments to someone else. Even mobile wallets like Paytm accepting loading via UPI, and given the government wants to promote this, don’t be surprised if more merchants starting accepting UPI soon.

So what’s so special about BHIM then?

BHIM also has options to transfer via IFSC, MMID as well for non-UPI banks. It also means the government has decided to go with one app that will enable digital payments. Of course until everyone starts accepting and activating UPI as a payment method, BHIM won’t be of use to a majority of people.

Let’s not forget that

Apple iOS users are out of this system for now, and that is a significant set of affluent users, who are likely doing a lot more digital transactions than Android folks. It also means even if most merchants accept UPI, a user will still need a smartphone, internet connectivity etc to conduct transactions.

In India, not everyone has a smartphone, and even most smartphone users face poor connectivity problems. From an infrastructure point of view, it is a still long way to go before BHIM becomes the default app for India’s 1 billion plus population. For now BHIM is another app to facilitate digital payments. Also the Aadhaar-based payments part for BHIM is yet to full roll out.

Your friend, relative or even a merchant who you’re trying to pay doesn’t necessarily need to be on the BHIM app.

Your friend, relative or even a merchant who you’re trying to pay doesn’t necessarily need to be on the BHIM app. BHIM also has options to transfer via IFSC, MMID as well for non-UPI banks.

BHIM also has options to transfer via IFSC, MMID as well for non-UPI banks.